Irs 2025 Income Tax Brackets. The federal income tax has seven tax rates in 2025: Irs tax brackets are divided based on your taxable income level, with different incomes taxed at.

Here’s how those break out by filing status: Learn how federal tax brackets affect income and explore tips for lowering your tax bill this year.

Irs 2025 Standard Deductions And Tax Brackets Ronald Johnson, In this video, cpa navi maraj will break down exactl.

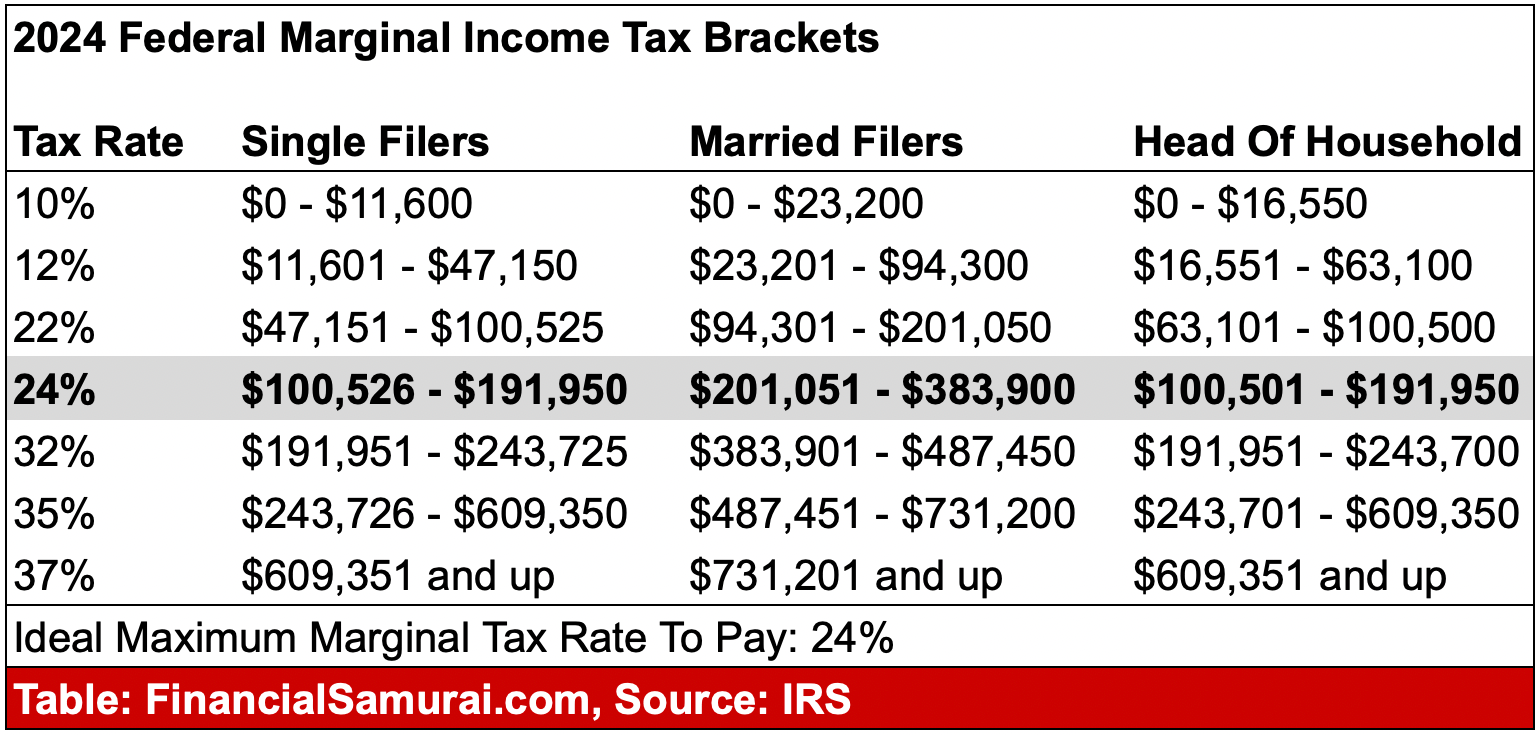

Irs Tax Brackets 2024 Vs 2025 Dyane Yasmin, In 2025, that rate will apply to taxable income of $626,350 and up for single filers, an increase from $609,350 the prior year.

Irs 2025 Tax Tables Pdf Stewart Morrison, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

2025 Irs Tax Brackets And Standard Deduction Dylan Lawrence, Each year, the internal revenue service (irs) adjusts income tax brackets to offset inflation.

2025 Irs Tax Brackets Chart Feliza Ronalda, See current federal tax brackets and rates based on your income and filing status.

Irs Tax Rates 2025 Marie Carlina, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

IRS Tax Brackets for 2025 Changes and How They Might Affect You, Irs tax brackets are divided based on your taxable income level, with different incomes taxed at.

Tax Brackets 2025 Single Person Alexander Forsyth, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Us Irs Tax Brackets 2025 Piers Piper, Irs tax brackets are divided based on your taxable income level, with different incomes taxed at.

What Are The Tax Brackets For 2025 Buffy Coralie, Individuals with a lower taxable income will be subject to a lower tax rate, and individuals with a higher taxable income will be subject to a higher tax rate.